Wills: Understand Your Primary Estate Documents

The best course of action when dealing with an inevitable outcome is to plan for it.

In this post, I'm going to help you better understand your will, which is your primary estate document. However, before we do that, I want to share some information about what happens if you don't have a valid will in place when you die.

What happens to your assets if you don’t prepare a valid will?

If you don't have a valid will in place when you pass away, you are said to have died intestate. By dying intestate, you didn't leave behind a set of instructions detailing how to manage the distribution of your assets. When this happens, the disposition of your assets reverts to the rules set out in succession law. It's important to note that succession law rules may not be in line with your expectations or wishes.

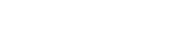

Here is a summary of the prevailing rules, according to the Ministry of the Attorney General of Ontario, as of June 6, 2020.

For additional distribution information, head over to the ministry site.

As you can see, this distribution of assets is formulaic and may not follow your wishes. Besides, complications are likely to arise if you are a common-law spouse, have minor children, are divorced, or have children from a previous marriage.

Understanding succession law and estate distribution are paramount when setting your wishes down on paper. It's a primary reason advisors advocate that you speak with a qualified legal professional for assistance in drafting your central estate documents.

The role a will plays in your estate

Your will is arguably your most important estate planning document, as it covers multiple areas. Specifically, your will addresses the following four essential items:

- It names your executor (liquidator in QC) - The person who will administer your estate.

- It appoints guardianship for minor children.

- It defines the way you want your assets distributed on death.

- It names trustees - The individuals or corporations who will be the fiduciaries responsible for the assets held in the testamentary trusts you created in your will.

Ultimately, these four decisions will create your ultimate legacy when you pass away, so let's take a brief look at each one in more detail.

Whom should you name as an executor?

A good rule of thumb would be to consider someone qualified and willing to accept the role. I believe it's a best practice to ask the person you are naming as your executor in advance of the appointment. It’s helpful if you are sure they are both willing and able to accept the role.

In addition to naming an individual as your executor, you may also consider appointing a corporate executor to manage your affairs. Corporate executors are a great option because they bring a professional approach to managing your estate. Meaning, they will likely be more efficient in the setup and execution of the estate process. Raymond James Ltd. has recently launched this service, and you can learn more about Raymond James Trust Services by clicking on the link.

Naming guardianship for minor children

If you have minor children, this will likely be one of the most emotionally charged decisions you will have to make as a parent. You'll have to assess the qualifications of your choices, you'll have to agree with your co-parent, and you'll have to think about your children's best interests. Take your time, weigh out the pros and cons, and be comfortable and confident in your decision.

Managing the distribution of your estate assets

Your estate is not merely a collection of financial resources that you've accumulated over your lifetime; it also includes real property, heirlooms, art, and family items. Distributing your assets in a manner that is both equitable, lawful, and in keeping with your wishes might prove difficult.

First, it's essential to have a list of the items and resources you want your will to cover (I'd recommend making an exhaustive list of assets and liabilities).

Second, you'll want to discuss your choices with a legal professional. Your legal professional can walk you through both the legal ramifications of your decisions, and they'll have additional guidance for items that you haven't considered.

Lastly, you'll want to review the tax consequences of your decisions with your tax professional. It's surprising how many tax complexities exist. To learn more about the potential tax consequences at death, read this post.

Who to pick as trustees for your testamentary trusts?

This job is incredibly important. Your trustees become responsible for managing the assets you place in trust in the best interest of the beneficiaries you’ve defined for the trust(s).

Ideally, you'll pick an individual(s) who is both qualified, able, and willing to accept the responsibility. You'll also want to select someone with a high ethical character who will work diligently in the interest of your beneficiaries. Often the choice is the same as the executor but doesn't have to be.

Also, you can name a corporate trustee to manage this as well. Learn more about the Raymond James Trust Services offering by clicking the link above. I would also be happy to discuss this option with you.

Where to do from here?

Now that you are more familiar with the consequences of dying intestate and the critical role your will plays in your estate management process, it's reasonable to be thinking about what to do next. Consider the following four options as next steps for you:

- Use the Contact Us button at the bottom of this page to request and receive your complimentary Raymond James will planning guide. This guide will help you organize and list your assets and liabilities—the first step in organizing your affairs.

- Email me to set up your complimentary estate plan review. Do this if you already have a will but aren't sure it's written to meet your planning needs.

- Make an appointment with a legal professional to begin drafting your will. If you don't know any legal professionals who can assist with this line of work, please reach out, and I can make a few introductions.

- If the three options above don't meet your needs, please call or email me with your specific questions. I look forward to hearing from you.

Sincerely,

Kurt Lucier, CFA

Information in this article is from sources believed to be reliable. However, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Kurt Lucier, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their investment advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James advisors are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. Securities offered through Raymond James Ltd., member-Canadian Investor Protection Fund. Insurance offered through Raymond James Financial Planning Ltd., not a member-Canadian Investor Protection Fund. Raymond James Ltd. is a Member Canadian Investor Protection Fund.