You Need to Know the Difference Between RRSP Contributions and Deductions

It’s -9 degrees Celsius outside as I write to you from my warm and cozy office. I’ve had a number of conversations today about the importance of contributing to RRSPs, and one theme kept coming up over and over again during these discussions; the difference between an RRSP contribution and an RRSP deduction.

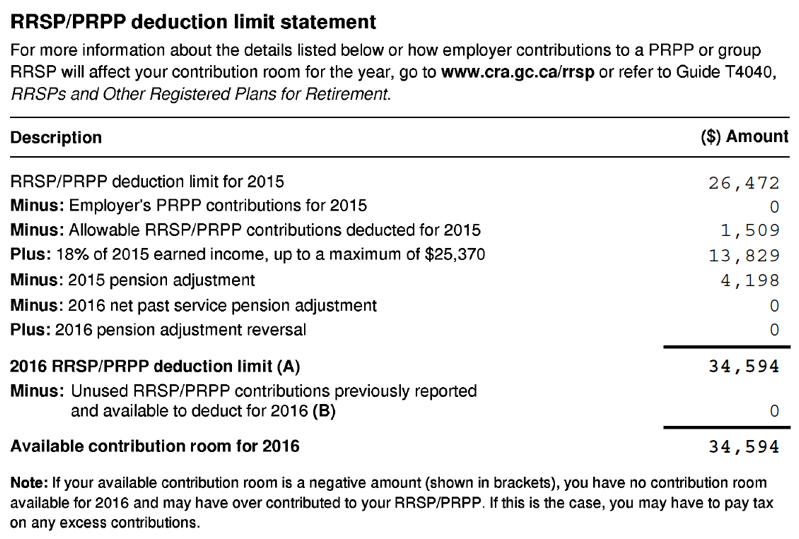

The image above is an RRSP deduction limit statement which is included in the notice of assessment that individuals receive from CRA every year. The statement is filled with a bunch of figures, but the line items I’d like you to pay closest attention to are the ones labeled 2016 RRSP/PRPP deduction limit (A) and available contribution room for 2016.

These two line items cause a lot of confusion, and it’s important for your financial wellbeing that you understand what they mean and how you can use them effectively.

First, we’ll tackle the deduction limit. The deduction limit is the amount of RRSP contributions (current or previous year contributions) that you are allowed to deduct from your income in the year (in this case 2016). This hypothetical individual can deduct $34,594 worth of RRSP contributions from their 2016 income. If they used the entire deduction limit, they’d reduce their income by $34,594 and this income reduction allows them to reduce their taxes payable for the year.

The available contribution room for 2016 is a different story. It’s the amount that you can contribute to your RRSP during the year (2016). In this case it amounts to $34,594, which is identical to the deduction limit. However, the deduction limit and the contribution limit do not have to be the same.

The RRSP program allows a person to contribute in one year, and carryforward that contribution to use as deductions in future years. Meaning, this person could contribute $34,594 in 2016 because they have both the capital and the contribution room limit available, but they wouldn’t have to deduct anything. They could carryforward all or a portion of the $34,594 to use in future years.

Why is this important?

It’s important because there may be times in your life when you are flush with cash, but low on income and vice versa. Contributing the maximum amount available will allow you to immediately save your capital and begin to earn tax deferred gains within the RRSP, while at the same time creating deductions that you can use at your convenience (now or in the future) to smooth out your tax liability.

Maximizing your RRSP contributions and optimizing the timing of your deductions are important considerations in any comprehensive wealth plan.

If you aren’t certain that you are utilizing these two tools (contributions and deductions) to their fullest potential, send me an email to kurt.lucier@raymondjames.ca with a brief description of your current circumstance and the questions that you’d like to have answered. I’ll respond to your email within two business days.

Sincerely,

Kurt Lucier, CFA